There are numerous factors to running a successful business; a solid and optimized strategy for managing Accounts Receivable (AR) is one of them.

Adopting an effective AR management approach benefits all sectors of a company, including marketing, sales, customer service, and overall company operation. Knowing how and where to start can be a challenge.

In this article, we’ll explain why optimizing your accounts receivable matters and share 4 strategies to help companies optimize their AR processes.

Why Does Account Receivable Optimization Matter?

Accounts Receivable management plays a crucial role in any business, as timely collection of invoices directly impacts the overall cash flow. Optimizing Accounts Receivable processes not only helps improve efficiency and productivity, but it can also lead to increased profits.

By streamlining invoice management and collecting payments in a timely manner, businesses can ensure that they have sufficient funds for day-to-day operations and future growth opportunities.

Additionally, optimization can help businesses create better relationships with clients by delivering clear and accurate invoices, ensuring prompt payment without the need for follow up reminders. In short, optimizing Accounts Receivable is key for both financial success and customer satisfaction.

Accounts Receivable management should be optimized as early as possible. Many companies are not aware of the importance of optimizing the Accounts Receivable process when they first start out and may be focused only on producing goods and services instead of simultaneously developing a solid accounting system.

By the time they realize just how detrimental an inadequately structured Accounts Receivable process can be, it may be too late to rectify the situation. Poorly optimized AR processes end up draining the company’s time, money, productivity, and ultimately its profitability by granting credit to unqualified clients and/or neglecting to follow up on late payments and past due accounts. Other common AR-related issues can include:

- incorrectly applying and allocating cash flow

- failing to pay attention to accuracy of customer data and payment options

- unknowingly continuing to sell to customers with unreliable payment records

- failing to develop and appropriately use reports to pinpoint potential issues

Any of these mistakes may have far-reaching consequences for even the most successful and profitable companies and it is essential to address them as soon as possible.

4 Strategies for Optimizing Your Accounts Receivable

Optimizing your Accounts Receivable process is crucial for running a successful business, but knowing where to start can be challenging. Here are four strategies you can employ to better optimize your Accounts Receivable:

1. Properly Evaluate Customer Financial and Credit History

Before granting credit to a new client — either a physical entity or a company — ensure that you conduct a thorough financial background check. Your finance team should also examine the customer’s credit records. Keep an eye out for lengthy lists of unpaid invoices – a red flag regarding a client’s creditworthiness.

Make sure to closely examine prospective clients’ credit reports and financial history. Never hesitate to request financial statements or bank guarantees. Your diligence will be valued by your clients, which can improve your partnership in the long run.

Additionally, you should optimize the credit approval process. This includes creating policies that define responsibilities between you and the client, assessing credit limits, and approving or rejecting credit applications within a specific timeframe. This process should be re-evaluated regularly.

2. Keep an Updated Customer Master Data List

Maintaining an efficient AR process requires a centralized customer accounts master data list, which ensures the accuracy of customers’ accounts and information. This includes:

- credit limits

- payment terms

- discounts

- tax rates

- return policies

- other relevant customer data such as mailing address and email

You should make sure that your customer data and agreed upon terms of each agreement are accurately reflected in your billing system. This includes the goods or services the customer is permitted to buy, payment terms, volume discounts (if any), and monetary restrictions.

Any error in data entry can have a major impact on your operations. For example, if you enter an incorrect email address, the electronic invoices won’t reach the customer, which will slow down receivables and interrupt your cash flow. Likewise, if your master data lists payment terms as 60-day, when they should in fact be 30-day, your company won’t be paid on time.

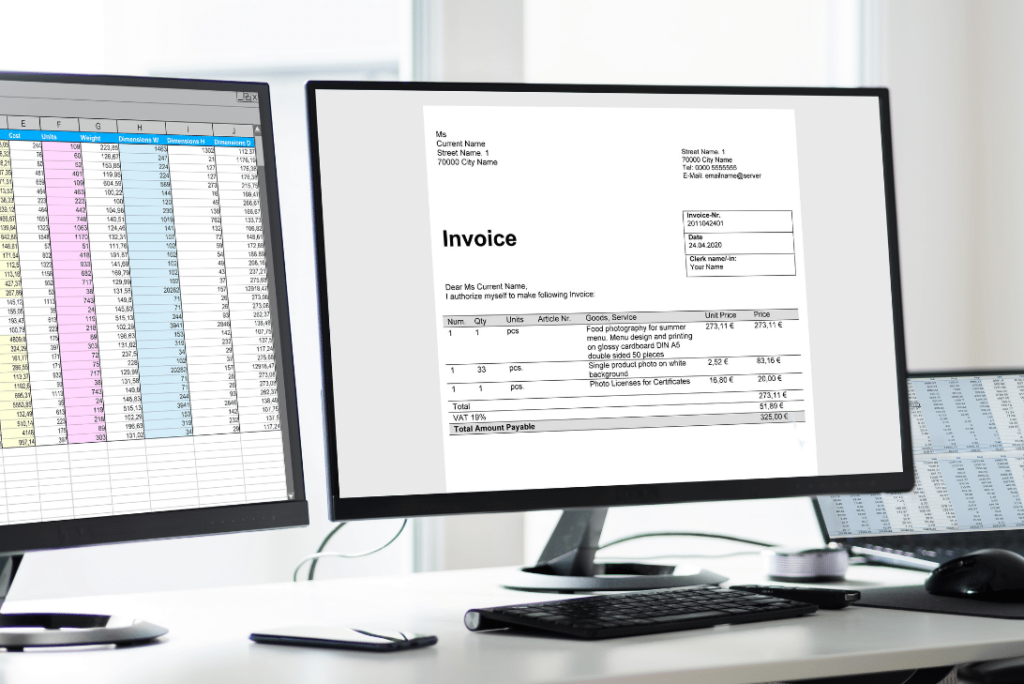

3. Automate your invoicing process

Billing and invoicing must be accurate to be effective as errors in this process can be time-consuming and costly to rectify. Invoicing should be done in a timely-manner. Invoice production should be standardized in order to minimize possible errors. You can accomplish both of these things by automating the billing process.

You can also create a customer portal to shift some of the work to the customers themselves. Integrating a portal into the process allows customers to download their invoices directly while reducing the time your team spends on the invoice delivery process.

New customers and clients should be introduced to these new processes from the start. Your sales and finance teams should plan an onboarding session for existing clients in order to familiarize them with these processes and answer any questions they may have.

4. Streamline Cash Application Process

Streamlining the cash application process will allow you to see which accounts are current and which are past due. An easy way to optimize this process is to reduce the number of payment options available. This not only simplifies the process but can also reduce potential errors.

Journal entries should be posted as soon as possible and ideally well before the cut-off dates.

Accounts should also be reconciled as early as possible. This will help minimize the number of payments that cannot be matched to an invoice and help you avoid depositing these funds into a suspense account.

Summary

The process of optimization begins by understanding the current state of your Accounts Receivables and performing a gap analysis to determine how your company performance compares to industry peers.

This holds true whether you need to entirely restructure your Accounts Receivable system or simply improve on existing policies. You can then determine which steps to take to best optimize your Accounts Receivable process.

Need help optimizing your Accounts Receivables ? AiVidens’ AI powered solution may be the option for you.

Contact us to learn more.