- In the previous blog, ‘Isn’t it time to optimize your working capital with AI-powered actionable insights?’, we discussed the macro- and micro- economical causes of late payments.

- We also discussed the potential consequences and business impact of late payments as well as AiVidens’ vision and approach to fully anticipate this payment behavior before it becomes reality.

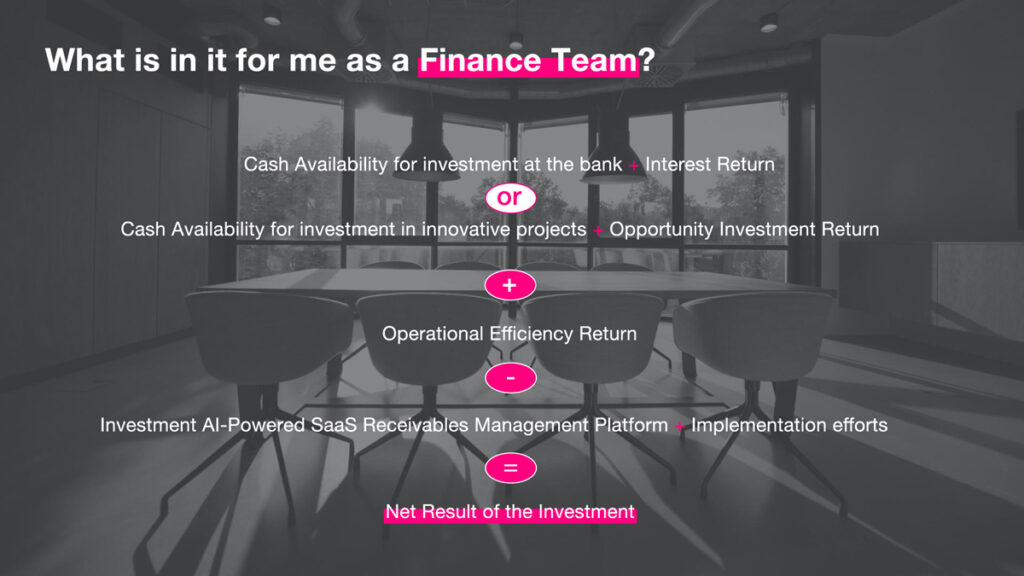

What’s in it for me?

As a Finance Manager, you may be wondering:

“What benefits could I achieve from improving some Key Performance Indicators to defend my business case internally?”

“At the end, we all want to improve and enrich our current (mostly expensive) ERP investments and/or traditional Collection tools with additional AI-driven insights as ammunition to improve our KPIs and build our business case.”

This blog post should support companies like yours in answering this question.

We have developed a model that calculates the potential financial returns and efficiency gains if potential payment problems can be proactively anticipated rather than trying to remediate them after the fact.

Before proceeding to the business case and starting our simulation, we must quickly assess the liquidity health AS-IS. For this purpose, we look at the parameters available in your company’s balance sheet and P&L.

Without going into all the details and calculations, we will highlight and describe a few key points.

A “AS-IS” Context

First, we collect and look at the following important parameters and analyze their evolution:

- Acid Ratio: The acid-test ratio, also known as the quick ratio, is a financial metric used to evaluate a company’s short-term liquidity. It measures a company’s ability to pay off its current liabilities without relying on the sale of inventory.

→ A ratio below 1 suggests that the company may struggle to meet its short-term obligations, signaling potential liquidity issues.

- Working Capital: Working capital is a financial metric that represents the difference between a company’s current assets and current liabilities. It is a measure of a company’s short-term financial health and its ability to cover its short-term obligations.

- DSO (Days Sales Outstanding): It is a financial metric used to measure the average number of days it takes a company to collect payment after a sale has been made. DSO is a critical indicator of a company’s efficiency in managing its accounts receivable and the effectiveness of its credit and collection processes.

- Number of Months where your Working Capital can fully cover the costs (to operate and run your daily business).

As soon as we have a clear picture of the current situation, we can start to look at some (simulated) scenarios where we want to understand the impact of potential improvements.

Business Model Drivers

Assume that we can bring down the number of DSO by 5 days thanks to the deployment of an AI-Powered Receivables Management Platform where you always start from on-time Insights (typically updated a few times a day) instead of solely relying on automating transactions often based on incomplete or obsolete payment and risk information.

→ The outcome our Model will provide major financial gains described below. These financial gains will support the Credit Manager to defend his/her investment in making the credit management not only more efficient but also more effective.

Financial Gains following the model calculations

- Gain in Cash: Here, we calculate the additional cash amount the DSO decrease (in our case 5 Days) will generate on your account over the coming years.

We can include – if relevant – also a revenue growth rate so that we have a more accurate representation of the gain in cash over several years in function of the foreseen growth rate.

With this Gain in Cash there are 2 scenarios possible :

- The Credit Manager can decide to put the cash in the bank > Interest Gain. Typically, at a rate of 3.40% today (status June 2024).

- The Credit Manager can decide to re-invest the cash (e.g., in innovation, sustainability, R&D, …) > Gain on the Opportunity Investment (or Avoidance of Opportunity Cost). Typically at a rate of 15%.

The Finance department will finally decide about the destination of the additional cash raised thanks to this more efficient and effective cash collection process based on AI-driven Insights.

- Gain in Operational Efficiency of the Cash Collection Team: In addition to the generated cash and the respective returns, we also calculate the operational efficiency gains thanks to the generated AI-Powered Insights.

Indeed, the Collection team will receive a Smart List (Agenda) with the prioritization of customers for each member of the team to be contacted each day and/or cases to be followed up with urgency.

These efficiency gains can only be generated thanks to the provision of continuously updated Smart Lists (coming out of the non-stop segmentations of customers with their respective payment profiles and risk type).

On average, the Operational Efficiency return amounts to 20% and is typically a salary cost that can be used for different purposes.

Results (per year) Calculations

Conclusion

We have provided some insights on how Finance departments could build a business case to defend a future investment in an innovative SaaS AI platform to cope with the increasing payment challenges in the marketplace.

Our model should give the Finance Department the necessary ammunition to defend his/her planned investment and achieve relevant investment prioritization across the company. This finance project can perfectly run alongside ongoing or planned IT initiatives.

We provide a concrete AI use case potentially resulting in a positive business case that can work with minimal IT involvement.

Nor does your project and business case have to be part of or embedded into a long-term resource-intensive IT migration project, nor should it be considered that way.

As mentioned, long-term migration projects will hardly solve your current and near-future overdue and bad debt issues, but:

- IT should however be (partially) involved to provide high-quality data and required data connections,

- and should be your Business Partner to support your financial KPIs.

Innovative companies use AI SaaS platforms as a ‘Sailboat’ accelerator (without any dependencies on existing technical debt) to achieve quick returns and supporting your finance objectives. We have seen other examples in the market where Finance AI initiatives are forced into a long and costly migration ‘container ship’ with uncertain outcomes, huge costs and unacceptable timelines.

Where do you want to be?

The model we highlighted above can provide you with the right foundation to have the right conversations inside your organisation to make investment decisions based on a solid business case.

The proof of the pudding is always in the eating. We would be very happy to further explore our model within your current business context. Please reach out to us if you would like to have more details and/or support in building your business case.